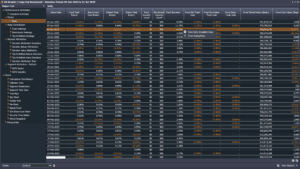

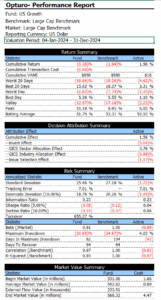

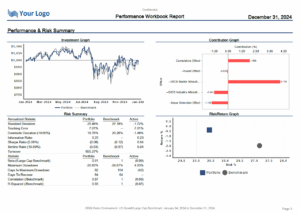

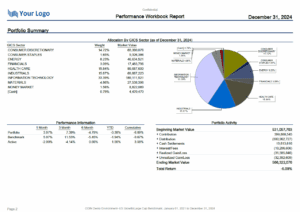

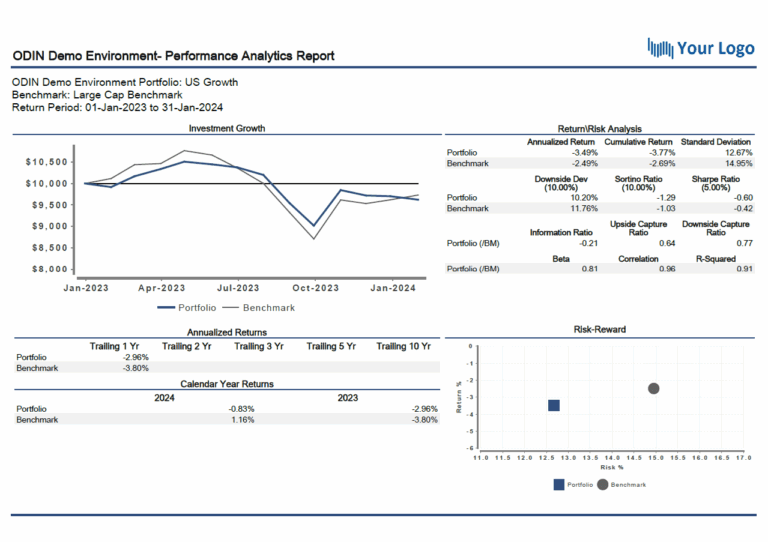

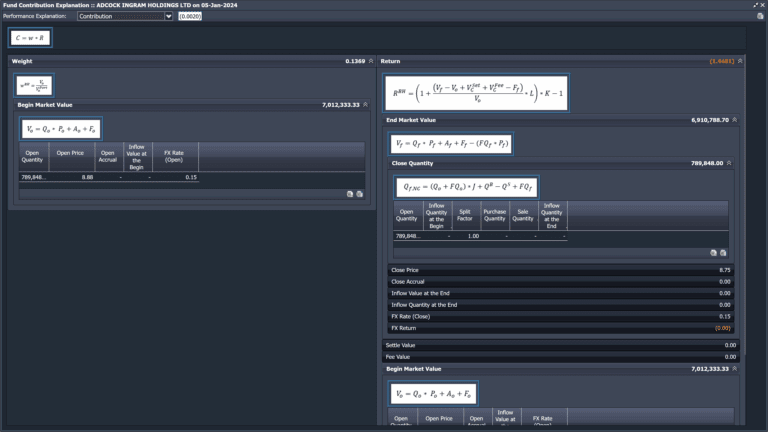

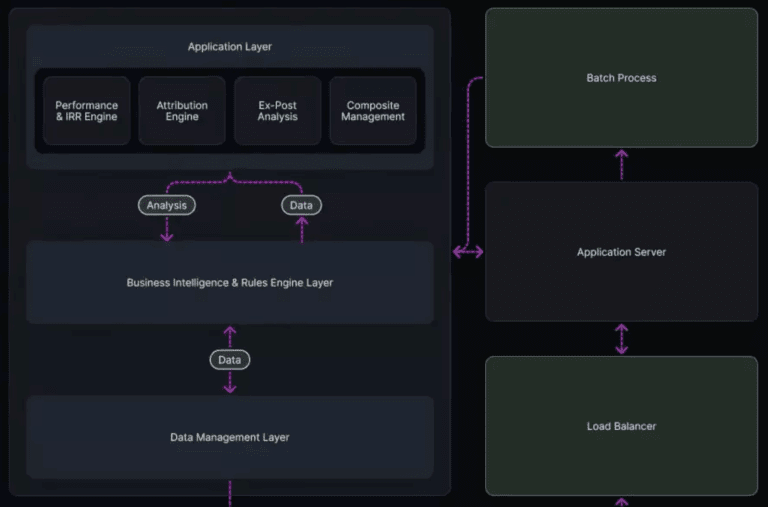

Opturo Performance is exact and built upon daily, component-level, trade-inclusive, multi-currency returns for both longs and shorts, and notional products. The analytics incorporate corporate actions, overnight cash flows and tax reclaim to provide accurate weights and returns for performance reporting and attribution while resolving notorious difficulties arising from intra-day transactions.

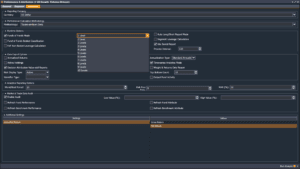

The AMIRR process that Opturo employs for calculating the money-weighted “Internal Rate of Return” (IRR) of a portfolio or segment thereof, enhances and corrects standard IRR calculations, such as those employed by Excel. As such, it is an indispensable tool for any performance measurement process concerned with money weighted returns, including segment, sector and/or security level short positions. Download sample segment drill-down report and source data of our IRR Calculations.

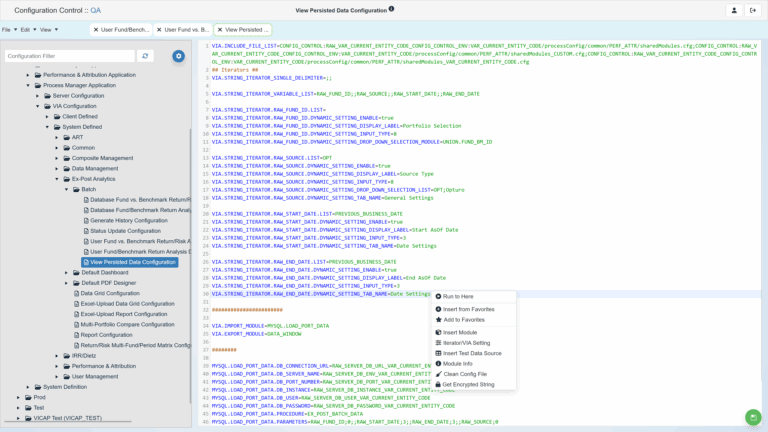

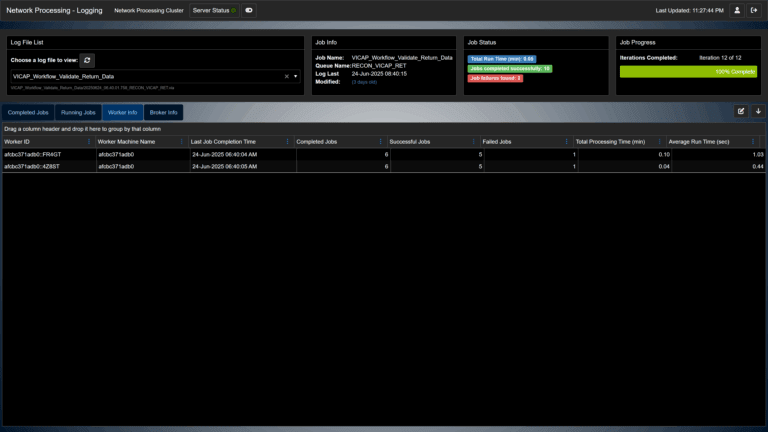

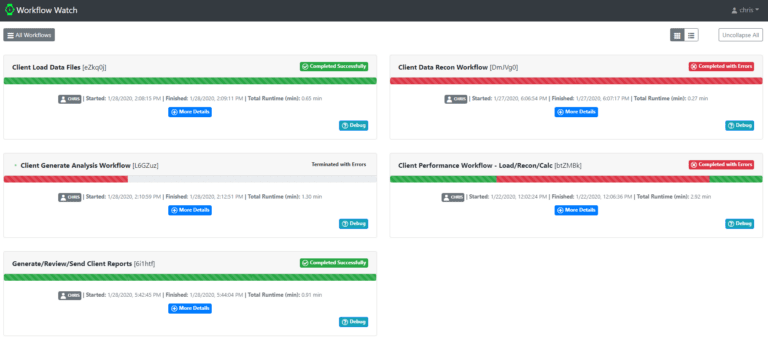

Performance and attribution terms are carefully made economically meaningful, avoiding the all-too-common critical calculation problems endemic in popular competing platforms. Opturo Performance correctly calculates the component-level returns for any possible transaction combination of sales, purchases, flips and shorts. The return for every instrument has the same sign as its gain and is never below -100%. Opturo also offers Real-Time Performance, which enables users to monitor intraday performance and integrate 3rd party data into a single reporting interface. Also, Opturo Performance leverages unparalleled data transparency within the platform to provide Middle and Back Office professionals with the tools required to Support and Reconcile all performance data and calculations.

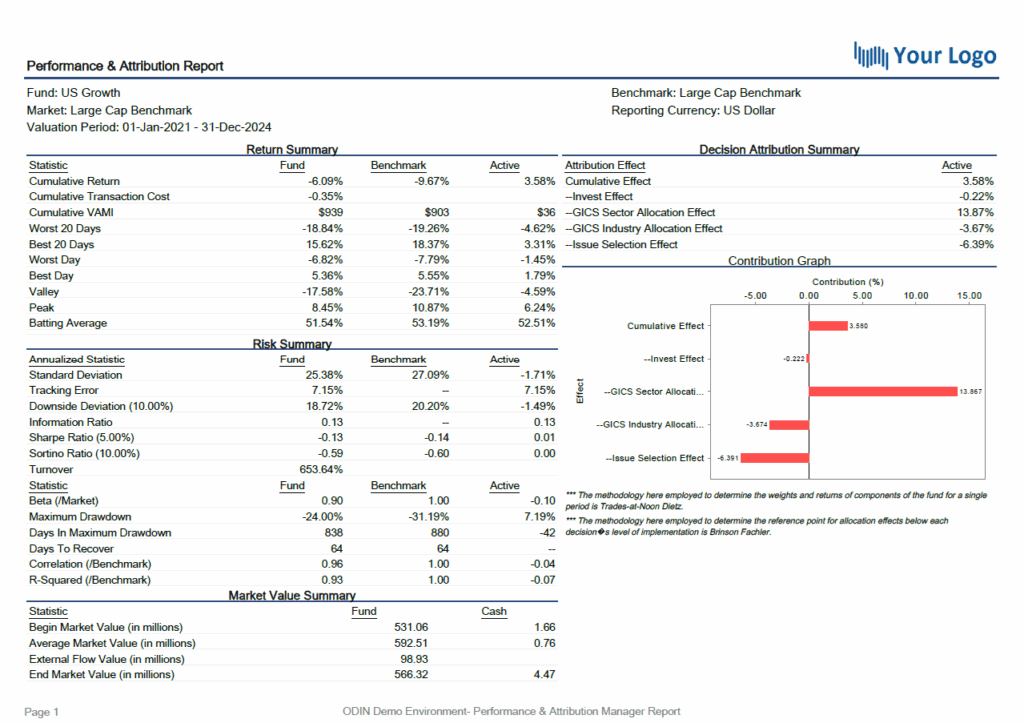

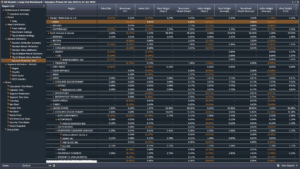

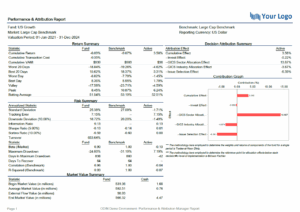

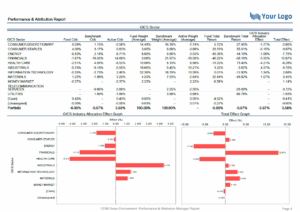

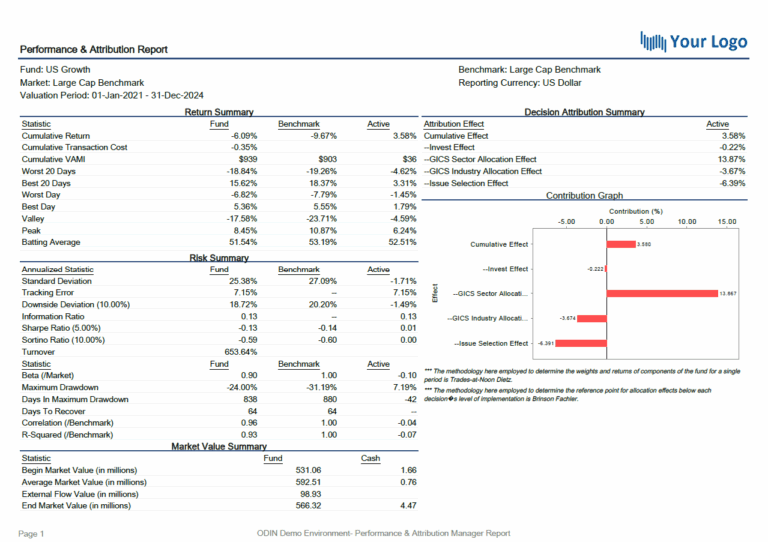

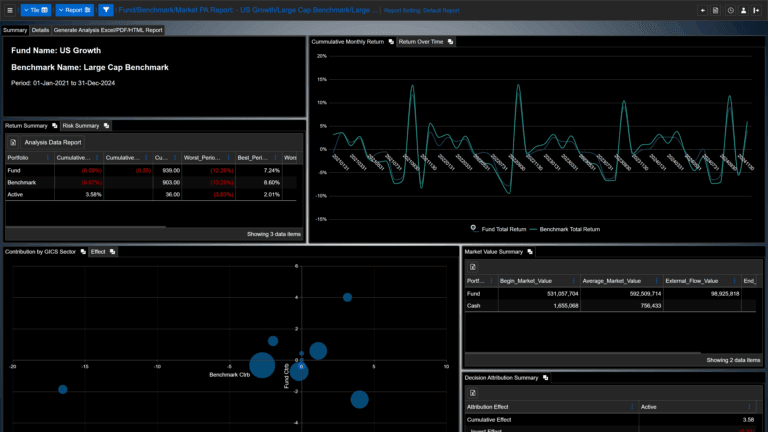

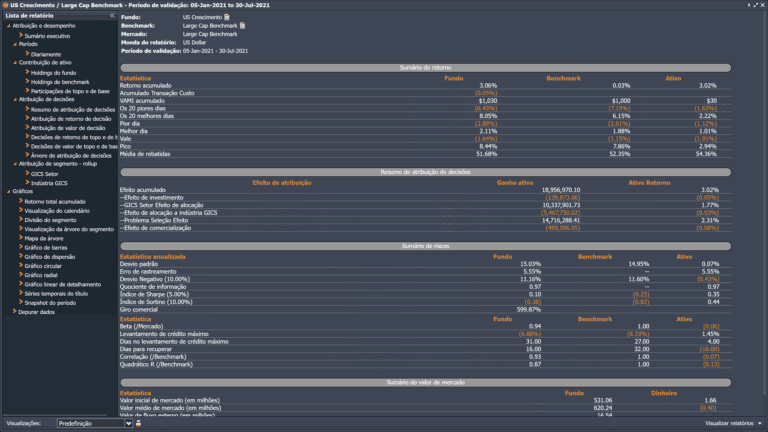

Decision Attribution

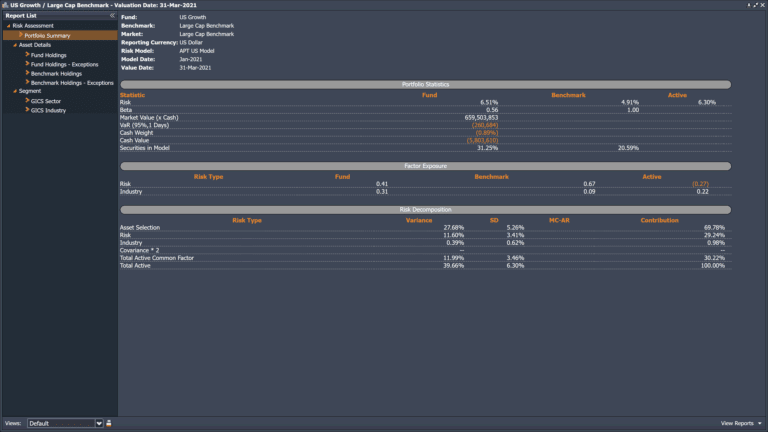

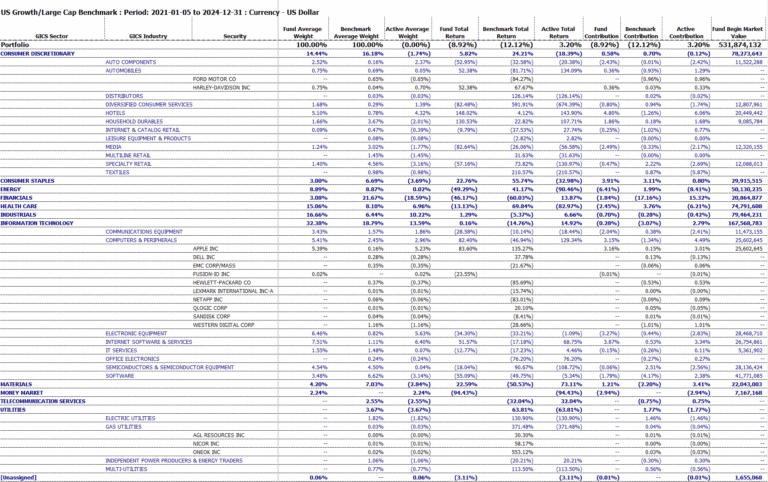

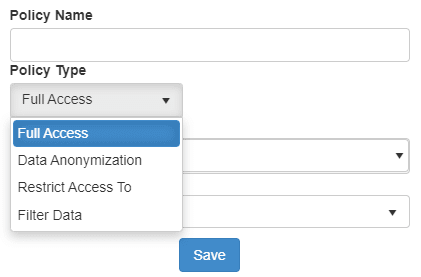

ODIN Attribution provides clients with the flexibility to select from a suite of best of breed models to meet their varied needs. Our proprietary Enhanced Brinson Fachler model empowers investment professionals to receive analytics which are based on how they actually make their investment decisions. If there is consistently applied logic and data to support it, our attribution engine can incorporate it into a decision tree – on the fly. Have a quant scoring method with multiple steps? Each step can be part of a decision tree and determine the alpha and risk generate by each. In combination with our ODIN Performance product, ODIN Attribution can handle any asset type and strategy. ODIN Attribution also provides the flexibility to select more traditional Brinson models, including a classic 2 step Brinson Beebower. Foreign exchange impact may be treated in a variety of ways, including decomposition or Karnosky Singer. Whether it be multi-asset or a traditional bottoms-up stock picking strategy, ODIN Attribution offers a way to provide economically meaningful analytics.

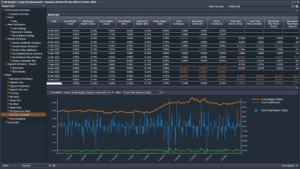

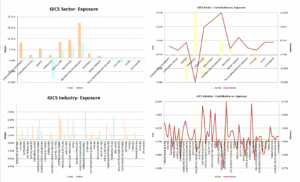

Market Attribution

Our Market Attribution models enable Fixed Income investors to determine the impacts of uncontrollable market movements on portfolios. Custom fixed income characteristics may be built on the fly and drive the decomposition of either nominal returns, or active returns relative to a selected benchmark. Are factor models part of your analytical arsenal? ODIN Attribution may be integrated with any factor model, whether it is provided by a 3rd party vendor or something you’ve built in-house. Perhaps your multi-asset group prefers one vendor and your fixed income group prefers another? No problem! Our platform is flexible enough to incorporate the data and logic you require to make your analytical process and associated reporting meaningful.

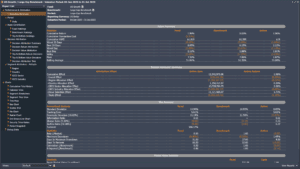

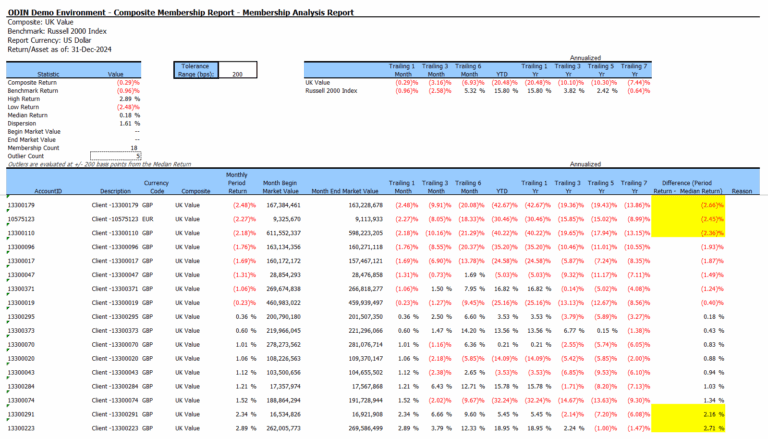

Analyst Attribution

Analyst Attribution is a specialized version of our proprietary Enhanced Brinson decision attribution model, which was developed to address the industry challenge of tracking and reporting upon the relative effectiveness of analyst ratings. Clients are able to use analyst ratings and have those ratings reflected in the security level weights in “paper portfolios.” Attribution may be run relative to the assigned benchmark, and/or referencing the real world portfolio. The result is an accurate framework to assess the job performance of research analysts, which may be used to assist in performance reviews, compensation incentives, etc.

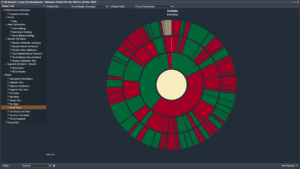

Market Decomposition and Attribution

Opturo offers Fixed Income and Factor Market Decomposition and Attribution that provides a deep dive into how market factors, such as interest rates, currency fluctuations, credit spreads, and yield curve shifts, have impacted fixed income portfolio returns. Ex post Fixed Income Market Decomposition evaluates these market impacts on the returns of issues, categories, and portfolios. Ex-post Fixed Income Market Attribution assesses their market effects on active fund returns. By breaking down performance into these components, investors can pinpoint the drivers of both positive and negative returns, assess the effectiveness of their investment strategies, and make more informed decisions about future portfolio allocations.

Download the Excel spreadsheet that illustrates the issues with Excel’s XIRR.

Public Market Equivalent Returns Provided by Opturo

The following are three different kinds of public market equivalent (PME) returns for a period that Opturo assigns to the pairing of any fund and any index portfolio, based on Opturo’s IRR calculations.

In the following, the incoming external flows of the fund are taken to include the fund’s opening market value, and the outgoing external flows of the fund are taken to exclude the fund’s closing market value.

PME is the IRR of the portfolio, calculated using the fund’s external flows and the index’s daily returns.

PME+ is the IRR of the portfolio consisting of the external flows of the fund and the adjusted daily returns of the index. Here, the adjustment scales the outward-flowing external flows so that the portfolio created by the adjusted external flows of the fund and the index’s daily returns has a closing market value equal to that of the actual fund.

PMER is the return whose return factor is calculated directly as the ratio of the market value discounted back to the open of the outgoing external flows and the closing market value, to the market value discounted back to the open of the incoming external flows. Here, all discounting is done by the index’s daily returns