Risk Model Inputs

The values below are contained in the selected risk model.

In the following inputs, we will let n denote the number of risk factors in the model, and let N denote the number of securities in some portfolio (e.g. the fund, benchmark, or market).

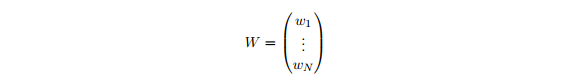

Security-level Weights

The first input into calculating risk are the relative weights of the securities in the fund, benchmark, and market. These are to be thought of as the open weights of the securities for the value data. We denote by

the vector of weights of the securities in a given portfolio. For example, wi might be the weight of the ith security in the fund, or in the benchmark, or its active weight in the fund relative to the benchmark.

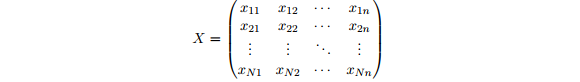

Exposure Matrix

The Exposure Matrix specifies how much exposure each security in the portfolio has to each risk factor in the risk model. Roughly speaking, the exposure of a security to a given risk factor measures the extent to which a security's variation is explained by the variation in a given risk factor.

For example, an airline company will have a relatively large positive exposure to oil prices, but probably a smaller exposure to the pharmaceuticals industry. A negative exposure implies that a security's return will be inverse to a change in the risk factor.

We let

be the N x n security-level exposure matrix. Here, xij is the exposure of the ith security to the jth risk factor.

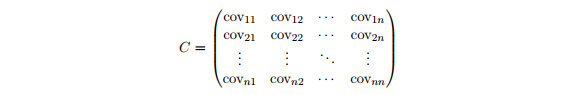

Risk Factor Covariance Matrix

The next input into the system is a matrix that measures how much independence there is amongst the risk factors. If there are n risk factors, this will be an n x n symmetric matrix. We let

denote the n by n covariance matrix. We will denote its (i, j)-entry by covij. This entry gives the model's projected covariance between the ith and jth risk factors.

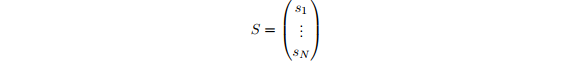

Specific Risk

The specific risk values for each individual security in the portfolio are the annualized risks of each security that are not explained by the risk factors. We let

be the vector of (annualized) specific risks of the securities. Here, si is the specific risk of the ith security.

Portfolio-Level Risk Factor Exposures

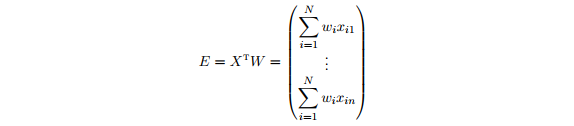

It will also be useful to combine the weight vector W and the security-level exposure matrix X to get a portfolio-level exposure vector that measures the exposure of the portfolio to each risk factor at the open of the value date. We will denote this vector by E, and define it as follows.