Ex-Post Risk Analysis Statistics

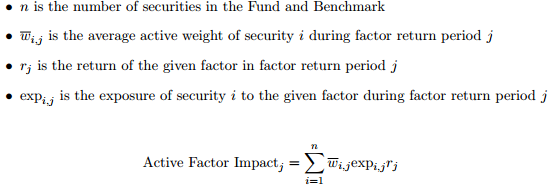

Active Factor Impact

The active factor impact is the active, exposure-weighted impactof a given factor for a given factor return period (e.g., a given month or week). It is defined as follows.

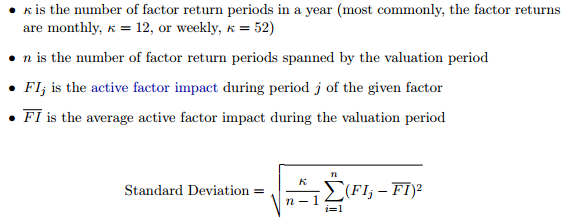

Standard Deviation

Standard Deviation measures the annualized standard deviation of active factor impacts. This can be thought of as an (annualized) tracking error number for each market factor in the factor model. These numbers gives a sense of the magnitude by which the Fund differed from the Benchmark in its impact from each market factor.

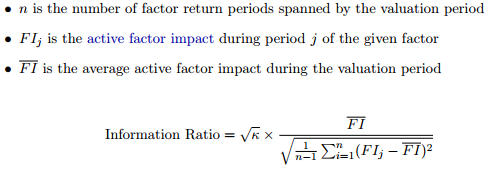

Information Ratio (Annualized)

Information Ratio measures the annualized risk-to-return ratio of the active factor impacts. This can be thought of as an (annualized) information ratio for each market factor in the model.

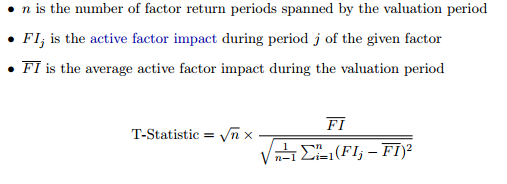

T-Statistic

The T-Statistic can be used to test the null hypothesis that there was no difference between the factor returns for the Fund and the factor returns for the Benchmark. A larger T-Statistic for a given factor means it is more likely that a non-zero factor contribution is statistically significant. On the other hand, a smaller T-Statistic does not preclude the difference’s being statistically significant.