Outlier Check

The outlier check will flag any accounts with returns outside a given range from the average composite return for that period. Which accounts get flagged in the outlier check is determined by two settings: whether to use asset-weighted or equal-weighted average, and whether to use a fixed number of percentage points or a standard deviation to determine an interval around the average.

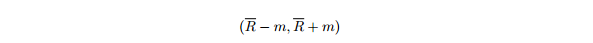

An account-level return will be flagged if it falls outside the range

where R is either the asset-weighted or equal-weighted average return and the margin m is either a constant (for example m = 0.02) or a constant number of standard deviations from the mean. The formulas for these different options are as follows:

Average Return Options

Asset-Weighted Average Return

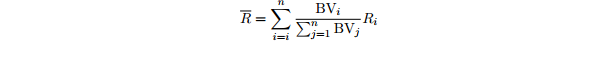

When choosing asset-weighted average, the average R is given by:

where BVi denotes the begin value of account i and Ri denotes its return, or equivalently but more simply,

where wi is the begin weight of account i.

Equal-Weighted Average Return

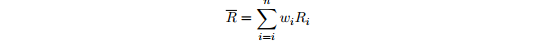

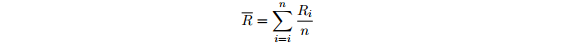

When choosing equal-weighted average, the average R is given by:

Ri denotes the return of account i. To see the parallel with the asset-weighted example, this is equivalent to

where the weights wi = 1⁄n are all equal.

Margin Options

The margin (±m) in the outlier check is given by one of the following two formulas.

Standard Deviation Check

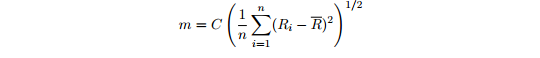

When using the standard deviation check, m is given by

where C is the user-defined constant (e.g. C = 2).

Return Check

When using the return check, the margin, m, is simply a user-defined constant.