Asset-Weighted vs Equal-Weighted

Asset-weighted calculations determine stock weights based on the value of the security/account relative to others in the portfolio/composite where equal-weighted calculations give all securities/accounts in the portfolio/composite the same weight.

Asset-Weighted Average Return Calculation

For asset-weighted return calculations, securities/accounts with a higher market value impact the average return of the portfolio/composite than securities/accounts with a lower market value with the same return.

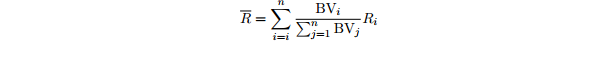

The asset-weighted average R̅ is given by:

where BVi denotes the begin value of security/account i and Ri denotes its return, or equivalently but more simply,

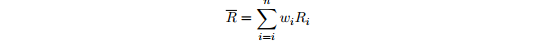

where wi is the begin weight of security/account i.

Equal-Weighted Average Return Calculation

For equal-weighted average return calculations, the market value is ignored since all securities/accounts in the portfolio/composite are assumed to have the same weight.

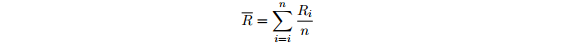

The equal-weighted average R̅ is given by:

Ri denotes the return of security/account i. To see the parallel with the asset-weighted example, this is equivalent to

where the weights wi = 1⁄n are all equal.