Performance Methodology

The goal of this section is to explain how each performance methodology available in ODIN computes bases, weights and returns at the security-level for a single period. Once the calculations are understood for a single security and single period, they can be rolled up across securities and/or compounded across periods, as is explained [here.]

The available methodologies in ODIN are:

- Buy and Hold

- Trades-at-Open Dietz

- Trades-at-Noon Dietz

- Trades-at-Close Dietz

- Purchases-at-Open Dietz

- Follow the Money

Since Follow the Money is Opturo's proprietary performance methodology, we will omit the details of its calculation from this guide. We remark that although it shares features with the other methodologies, it has many advantages. For example, in contrast to the Dietz methodologies, using Follow the Money in a long-only portfolio, returns will always be greater than -100% and weights will always be between 0$ and 100%.

Security-Level Bases and Weights

We first begin by discussing the key concept that varies between the Dietz methodologies, namely the notion of a basis for each security. As a reminder, everything we discuss below is for a single period.

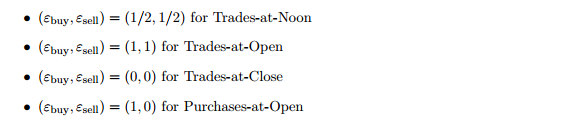

Dietz Weights Before we discuss the important notions, we introduce the notion of a Dietz weight, whose exact use is discussed in the calculation of the Dietz bases. The Dietz weights are defined as follows:

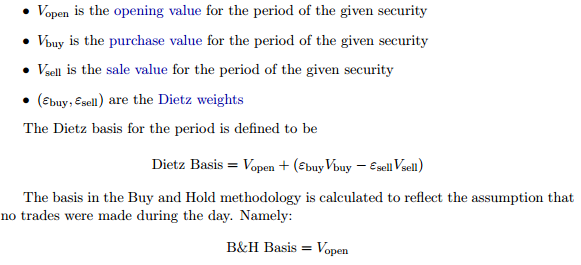

Basis For a single period, each Dietz methodology varies by how it weights the purchases and sales of each security, reflecting an arbitrary choice for when trades occurred. For non-Cash instruments, the basis is calculated as follows:

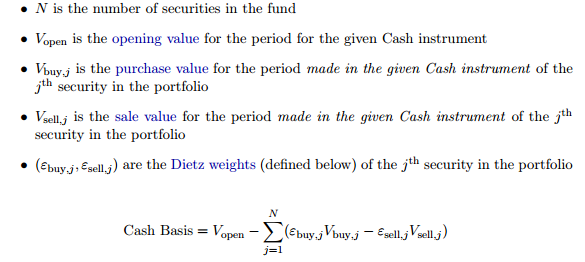

For Cash instruments, the basis is slightly more complicated. The idea is that fluctuations in cash caused by trades should not affect its basis. Thus, in the calculation below, we add back in the cash used for purchases and remove the cash realized in sales. This is further complicated in a multi-currency portfolio, where different instruments are bought and sold in different currencies. The precise calculation is as follows:

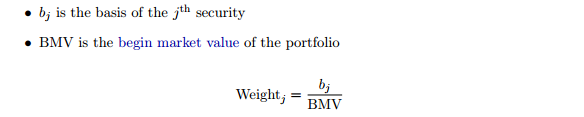

Weights Once we have the notion of a basis, the different methodologies calculate weights identically. Namely:

where here Weightj denotes the weight of the jth security. It follows that the sum, over all holdings including all Cash holdings, of the weights is always equal to one.

Returns

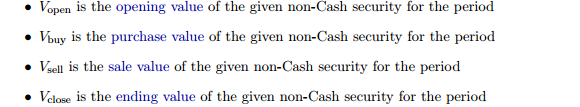

Gain for non-Cash Securites In order to calculate returns, we need the notion of gain. With the exception of Buy and Hold, each methodology calculates the gain as follows for non-Cash securities.

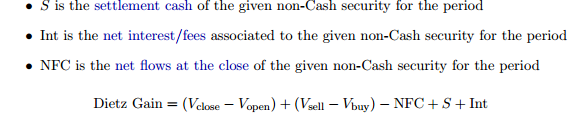

For Buy and Hold, since we are assuming there are no trades for the day, the calculation is simply

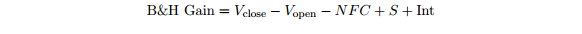

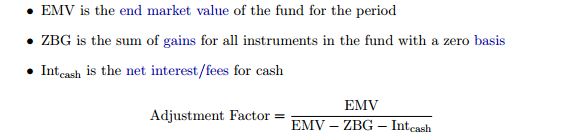

Adjustment Factor In the definition of security-level return below, we must divide by the basis of a security to calculate its return. However, it can happen that a security has a zero basis. For example, in Trades-at-Close, a security might not be held at the beginning of the period but be held at the end. The gains in that security are then spread across the fund. Also, the return for fees and interest applied to cash is also spread across the fund. This is done by multiplying security-level return factors by an appropriate adjustment factor, which is defined as follows.

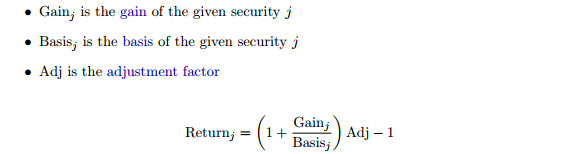

Return Now that we have notions of basis and gain, we can define returns. With those definitions in hand, returns are calculated the same for all methodologies and all types of instruments. Return is calculated as follows for securities with a nonzero basis:

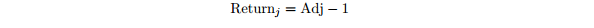

For securities with a zero basis, their returns are given as follows: