Software Solutions for Analytics and Data Driven Service Operations

Since 2008, Opturo has provided holistic approaches to achieving and maintaining peak operational efficiency within the financial industry and beyond.

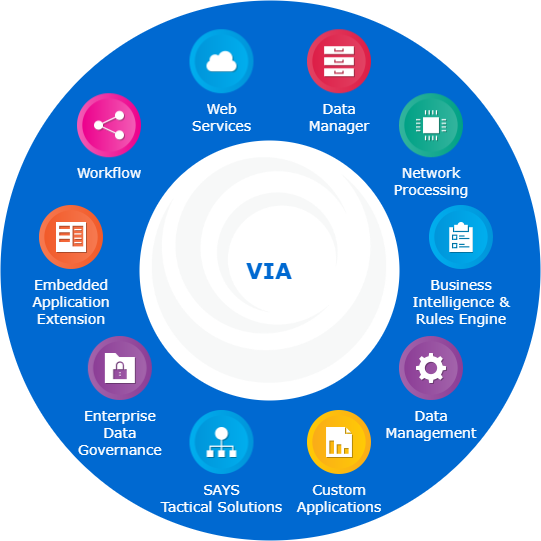

Our cloud-hosted solutions powered by AWS

On-site bolt-on analytics & operations optimization

APIs for our analytical engines

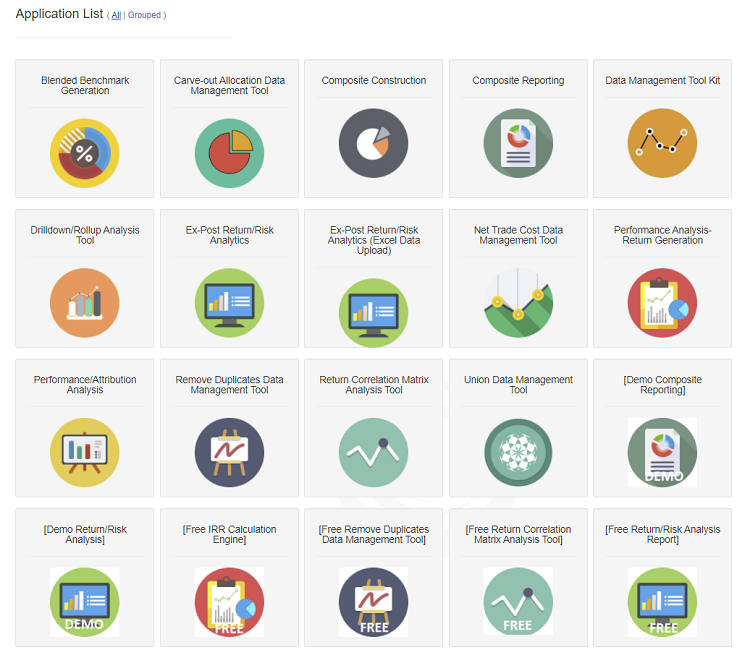

Featured Products

Process Data & Reporting Fast

Leverage our distributed computing and network processing dashboard to do investment and data analytics at scale.

Connect Multiple Data Sources

Merge and utilize data from multiple data sources and any data format.

Monitor & Manage Your Data Workflows

Manage running workflows and signal when reports and processes complete.