Performance & Attribution powered by SAYS

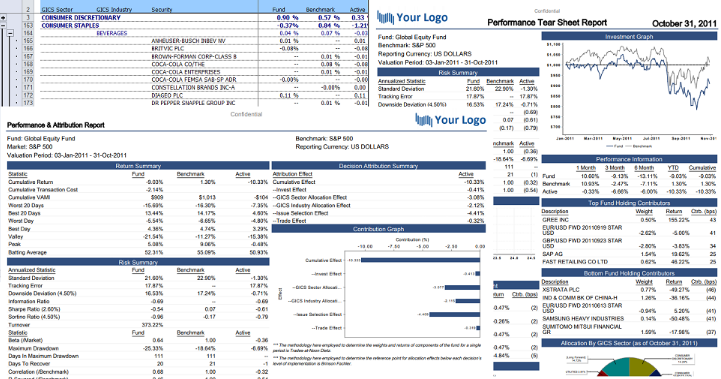

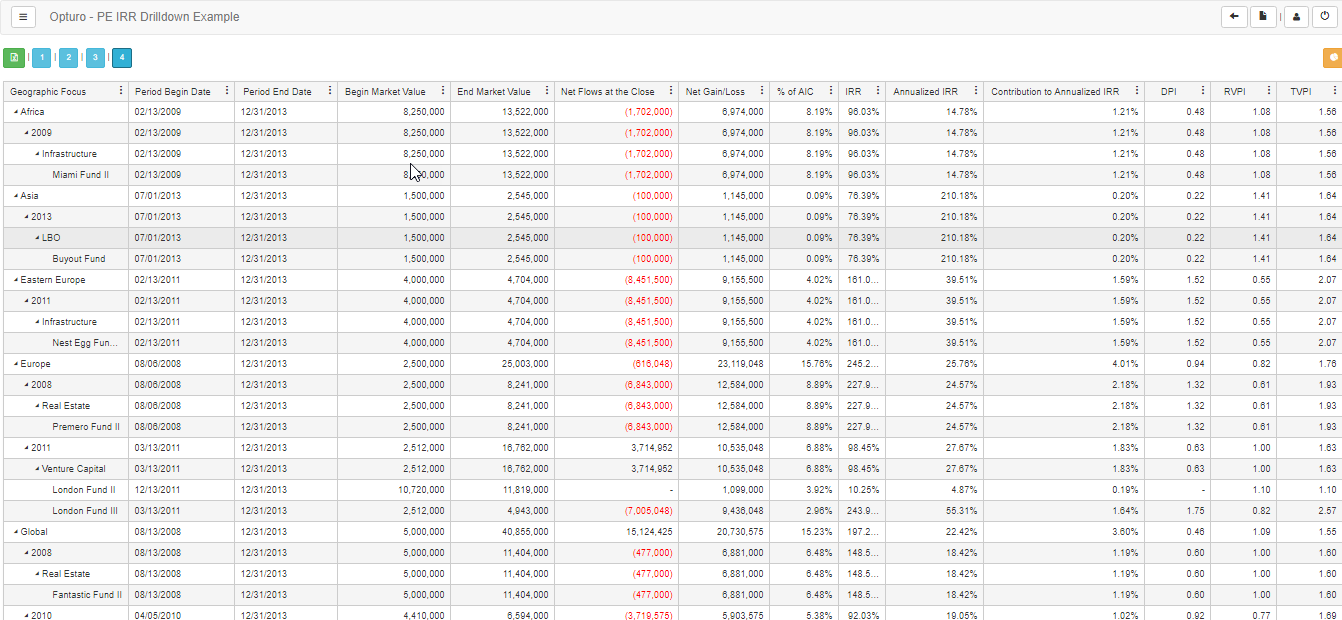

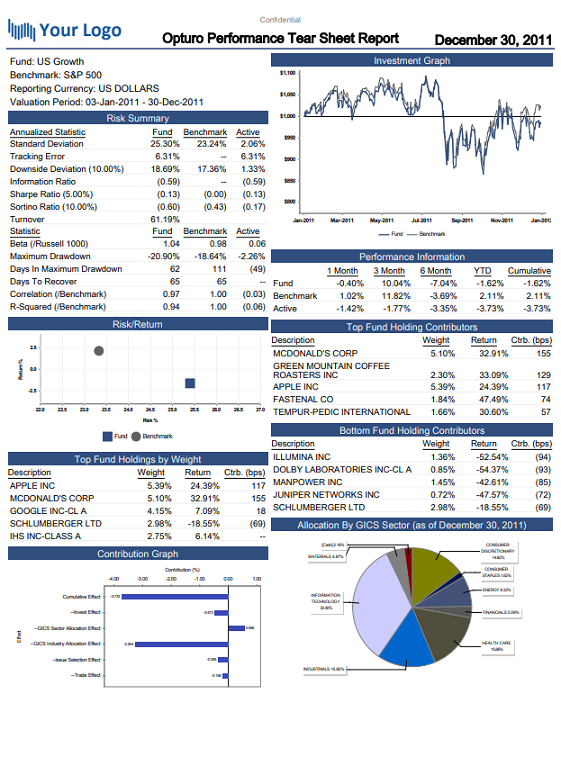

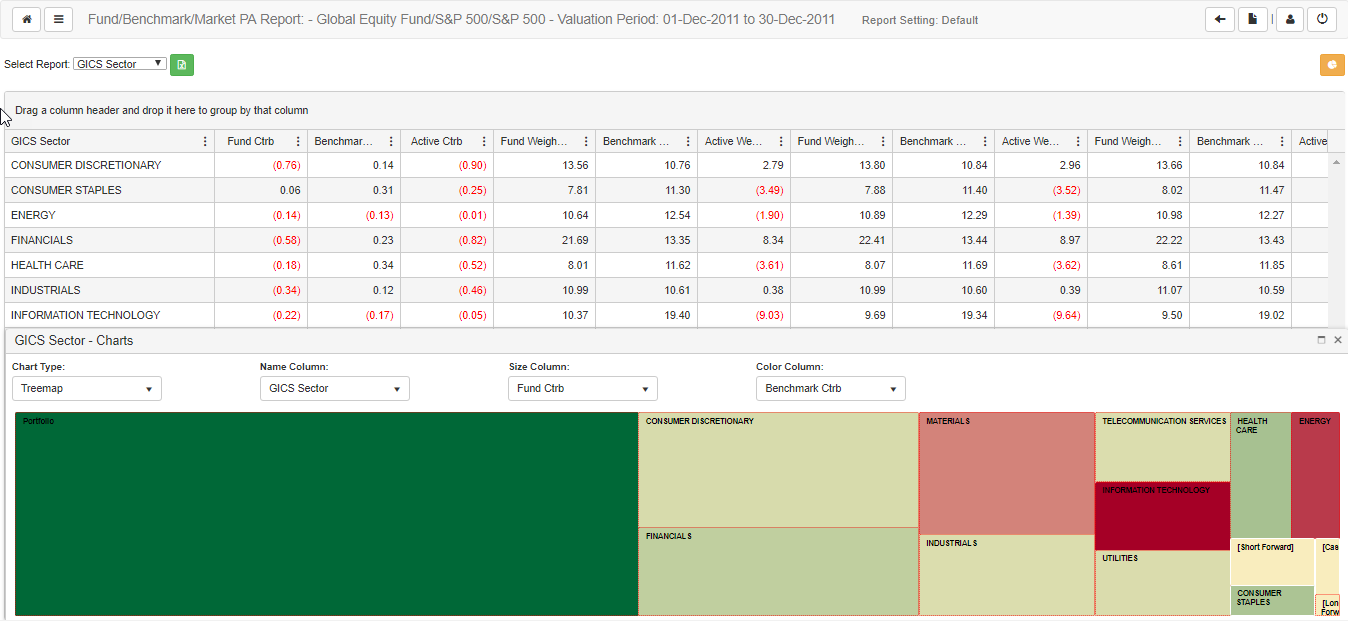

The modular design of our SAYS platform enables Opturo to offer users a tactical approach to addressing performance and attribution requirements. Users may subscribe to access portfolio level performance analytics and reporting using market values and flows to enable TWR and/or IRR return methodologies. For those users who require more robust security-level analytics, including decision attribution, users can generate accurate performance and attribution to the deepest level the data will allow.

Leverage the power of the SAYS platform to address your performance and attribution needs.